SRPF «ARGUS» Ltd. within signed contract with Deposit Guarantee Fund http://www.fg.gov.ua/en/ developed Automated payment system of the Fund (ASVF) – which allows to fully automate the entire process of paying compensation to depositors of insolvent banks in accordance with Ukrainian law.

Aims and objectives of the project:

- Data consolidation in integrated automation system

- Providing simultaneous online access to database for payments to several Agent banks

- Centralized control of the payments

- Reduction of paper workflow

- Prompt response to the depositors requests

- The possibility of flexible changes in the software operation in case of legislative changes

- Rapid acquisition of various data for analysis with the ability to export to different formats

- Increasing depositors loyalty to the banking system

- Increasing the quantity of Agent banks who have an access to the payout system

- Extremely reduction of the terms of reimbursements to depositors

- Providing depositors with a choice of Agent bank

- Reducing the operational risks of DGF due to full circle control over the payment process

- Flexible management of the DGF over payout process

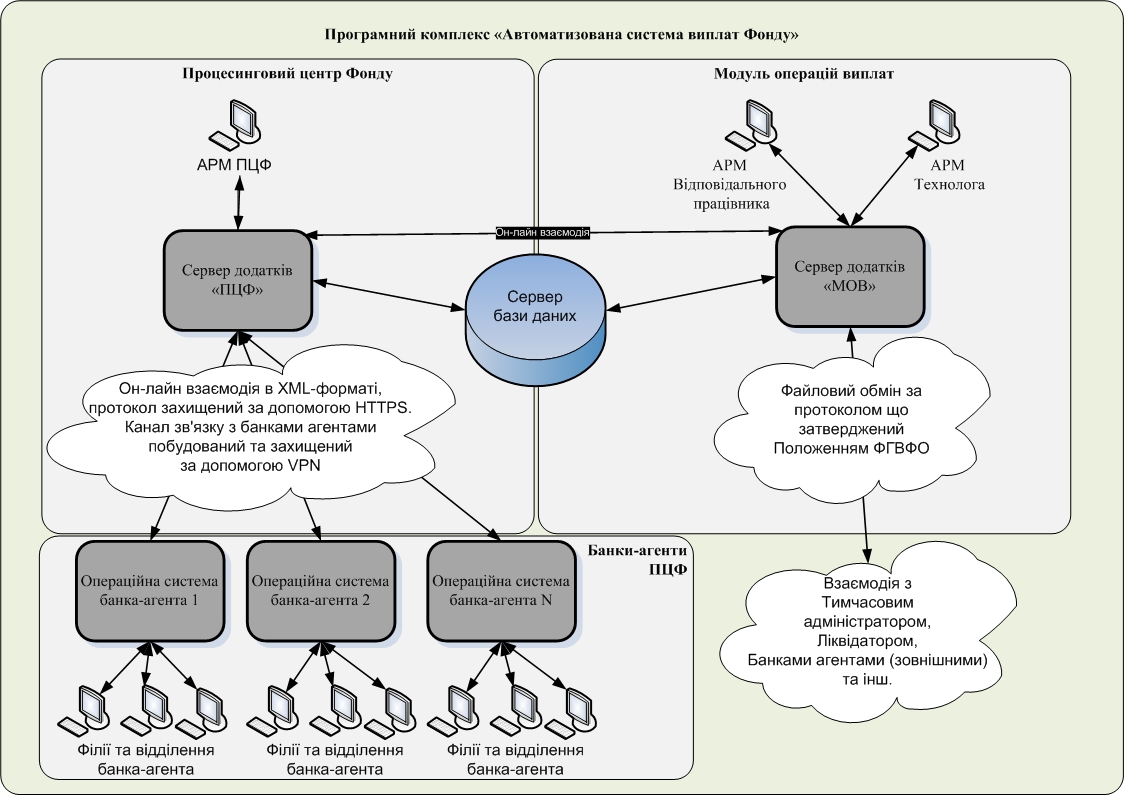

ASVF consists of two main components:

The payment operations module (MOV) is the main accounting system (back-office of the Fund) responsible for interaction with failed banks, calculation of covered amounts, mutual settlements with Agent banks.

Processing center of the Fund (PCF) is a transaction processing system (front-office of the Fund) providing on-line payments.

For the interaction of Agent banks with the Fund the online protocol was implemented.

The system allowed the Fund to meet the following goals:

- pay out only for realized payments of compensation to Agent banks (before the implementation of new technology, funds were transferred in advance to the account of a specific agent bank, which could make payments only in its branches);

- accelerate the beginning of reimbursement payment (up to several days after the decision on insolvency of the bank);

- give depositors the choice to receive compensation in any office of any Agent bank (before the implementation, the depositor could receive compensation only in the branch of a particular agent bank);

- avoid queues in the offices of Agent banks at the beginning of the procedure of payments due to increasing of the number of payment points;

- get full control and have online statistics of the performance of current payments;

- fully automate the process of payment of reimbursements, avoiding errors and delays caused by the influence of the “human factor”.

ASVF has options of integrate with external systems

It is possible to quickly implement solutions for integration using vary interfaces.

Integration options:

- file exchange (using file formats csv, xml, xls etc.)

- oracle db-link

- online processing of packages (client-server technology)

Existing solutions of integration:

- with electronic document management system

- with accounting system

- with CRM system (call-center)

The results of system operation are available for browsing and analysis in the form of:

- Grids in the desktop application (with the flexible abilities of customize the list of displayed fields, filtering, sorting data and uploading to external files)

- Reports

- Files DOC, XLS, PDF, CSV etc.

- Online and offline reports in agreed formats (for transfering to external systems)

The safety of data storage and processing is based on:

- Usage of a secure database – RDBMS Oracle

- Differentiations of access to information and management of the users rights to database objects and the UI functions (up to the visibility of a certain data fields and function buttons)

- Usage of the controller confirmation mode for all critical actions of users

- Logging of all the actions of the Agent banks and the Fund users

- Storage of all online sessions to PCF.

Developed for the interaction of Agent banks with the Fund, the online protocol allows to perform all actions related with payments directly in the Core banking system of the Agent bank. The online protocol is built using recognized industry standards such as:

- XML as an applied data transfer protocol

- HTTPS as a secure protocol (for encrypting we use SSLv2/SSLv3/TLSv1)

- TCP/IP v 4 as a transport protocol

System requirements

DB servers

- сould be chosen any OS compatible with RDBMS Oracle;

- SRPF “ARGUS” recomends OS Oracle Linux Server 5.6 (x86_64);

- RDMS Oracle Database 11g Enterprise Edition Release 11.2.0.3 (Pathset 2);

Application server for Processing center of the Fund

- OS Windows up to 2000;

- Oracle Database Client 11g (11.2) or newer.

Client side

- Oracle Database Client 11g (11.2) or newer;

- OS Windows up to 2000.